The power to tax is the power to destroy, which is why Ron Paul will never support higher taxes.

Our national debt is currently over $14 trillion, with the government spending nearly $2 trillion more per year than it collects. The American people should not have to pay for Washington’s reckless and out-of-control appetite for debt.

High taxes stifle innovation, prevent saving, destroy production, crush the middle class and the poor, and discourage investment. Every American is entitled to the fruits of his labor, especially during these tough economic times.

Lowering taxes will leave you more money to take care of yourself and your family, and it will allow businesses greater opportunities to hire new workers, increase current salaries, and expand their companies.

As President, Ron Paul will support a Liberty Amendment to the Constitution to abolish the income and death taxes. And he will be proud to be the one who finally turns off the lights at the IRS for good.

Capital gains taxes, which punish you for success (and interfere with your efforts to hedge against inflation by purchasing gold and silver coins), should also be immediately repealed.

Struggling college students and those working to support their families would be greatly benefited and receive an immediate pay raise by eliminating taxes on tips.

As a congressman, Ron Paul has consistently endorsed legislation to let Americans claim more tax credits and deductions, including on educational costs, alternative energy vehicles, and health care. He also believes it is immoral to tax senior citizens twice by requiring them to include Social Security benefits in their gross income at tax time. A first step to eliminating that requirement would be to repeal the 1993 increase in taxes on Social Security benefits. Then we must abolish that tax entirely.

While a Flat Tax or a Fair Tax would each be a better alternative to the income tax system, Congressman Paul believes we would have to guarantee the 16th Amendment is repealed to avoid having both the income tax and one of these systems as an additional tax.

But there is a better way. Restraining federal spending by enforcing the Constitution’s strict limits on the federal government’s power would help result in a 0% income tax rate for Americans.

The answer to spending and debt is to return to a constitutionally limited government that protects liberty – not one that keeps robbing Peter to pay Paul.

Oh Zee shares his opinion on Politics, Business, Food, Clothing, Music, and Movies, both locally, and on an International level.

Pages

SEARCH

Custom Search

Sunday, February 19, 2012

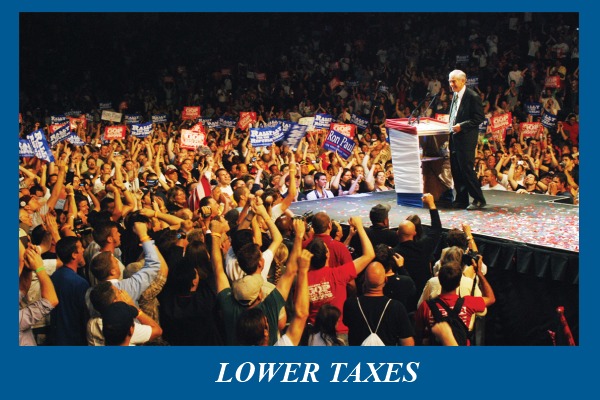

Dr. Ron Paul; His Take On Taxes

Labels:

2012,

America,

iowa,

iran,

knkt,

political,

politics,

profit,

race,

republican,

rich people,

ron,

SF Bay Area,

stanford routt,

t,

tax,

us gov

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

share your thoughts...