Oh Zee shares his opinion on Politics, Business, Food, Clothing, Music, and Movies, both locally, and on an International level.

Pages

SEARCH

Custom Search

Showing posts with label politics. Show all posts

Showing posts with label politics. Show all posts

Saturday, September 15, 2012

This Is Port City: Suspected Mexican teen assassin, 16, linked to 50 ...

This Is Port City: Suspected Mexican teen assassin, 16, linked to 50 ...: MEXICO CITY (Reuters) - Mexican prosecutors said Thursday they were investigating a 16-year-old suspected hitman who was believed to have p...

Labels:

abel,

cain,

cartels,

friday,

have it your way,

health,

illegal,

immigration,

jumping,

mexico,

NFL,

politics,

touchdown,

warfare

Location:

United States

Saturday, July 14, 2012

Saturday, June 16, 2012

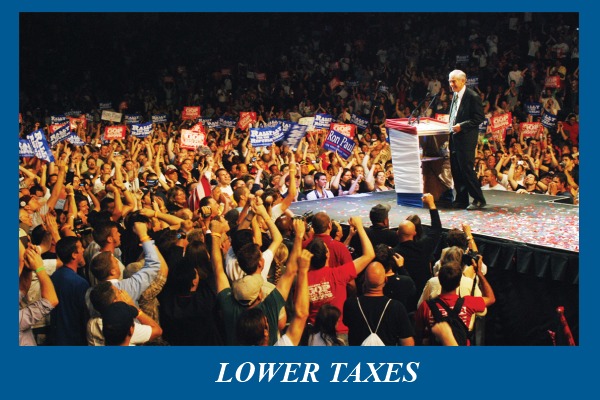

LET'S Go Dr. RON PAUL, America is Behind you!

Labels:

amazing,

American,

American Citizen,

and blue,

CA delegates,

doctor,

dr.,

endorsement of the youth,

politics,

Red,

United States of America,

webMD,

White

Location:

Washington, DC, USA

Friday, May 11, 2012

EXCLUSIVE: Ron Paul Shocks Campaign Staff With New Position On Israel

Republican presidential hopeful Ron Paul revealed this week that he would support moving the U.S. Embassy in Israel to Jerusalem, a surprising position that contradicts conventional wisdom about Paul's stance toward the Jewish state.

Paul first made this position known Wednesday night, during a private meeting with evangelical leaders interested in helping the Texas Congressman reach out to the conservative Christian community.

According to a transcript of the meeting obtained by Business Insider, the leaders started off the meeting by asking Paul whether he would sign an Executive Order to move the U.S. Embassy in Israel from Tel Aviv to Jerusalem, a major policy objective for Israeli hardliners and many leaders in the Christian Right.

"The real issue here is not what America wants, but what does Israel want," Paul told evangelical leaders, according to a transcript of the meeting obtained by Business Insider. "If Israel wants their capital to be Jerusalem, then the United States should honor that."

"How would we like it if some other nation said 'We decided to recognize New York City as your capital instead, so we will build our embassy there?'" he added.

Even Paul's senior campaign aides were surprised by his response.

"We were floored," senior advisor Doug Wead told Business Insider. "It sounds like pure Ron Paul, but it still caught us off guard...If someone would have asked him that in a national debate, I suppose it would have popped right out, but nobody did!"

Wead added that Paul's position "makes sense after the fact," noting that the candidate has frequently emphasized Israel's sovereignty.

Still, Paul's stance will likely come as a surprise to GOP leaders, most of whom view Paul's non-interventionist foreign policy ideas — and particularly his stance towards Israel — as his greatest weakness. The septuagenarian Congressman has largely been snubbed by the right-wing Jewish community, and was even excluded from a December presidential candidates' forum hosted by the Republican Jewish Coalition because of his "misguided and extreme" foreign policy views.

"I appreciate what he said about Israel — as a matter of fact, I was pleasantly surprised," Brian Jacobs, a Texas pastor who attended Wednesday's meeting, told Business Insider. "It helped answer a lot of questions that I had."

Read more:

Paul first made this position known Wednesday night, during a private meeting with evangelical leaders interested in helping the Texas Congressman reach out to the conservative Christian community.

According to a transcript of the meeting obtained by Business Insider, the leaders started off the meeting by asking Paul whether he would sign an Executive Order to move the U.S. Embassy in Israel from Tel Aviv to Jerusalem, a major policy objective for Israeli hardliners and many leaders in the Christian Right.

"The real issue here is not what America wants, but what does Israel want," Paul told evangelical leaders, according to a transcript of the meeting obtained by Business Insider. "If Israel wants their capital to be Jerusalem, then the United States should honor that."

"How would we like it if some other nation said 'We decided to recognize New York City as your capital instead, so we will build our embassy there?'" he added.

Even Paul's senior campaign aides were surprised by his response.

"We were floored," senior advisor Doug Wead told Business Insider. "It sounds like pure Ron Paul, but it still caught us off guard...If someone would have asked him that in a national debate, I suppose it would have popped right out, but nobody did!"

Wead added that Paul's position "makes sense after the fact," noting that the candidate has frequently emphasized Israel's sovereignty.

Still, Paul's stance will likely come as a surprise to GOP leaders, most of whom view Paul's non-interventionist foreign policy ideas — and particularly his stance towards Israel — as his greatest weakness. The septuagenarian Congressman has largely been snubbed by the right-wing Jewish community, and was even excluded from a December presidential candidates' forum hosted by the Republican Jewish Coalition because of his "misguided and extreme" foreign policy views.

"I appreciate what he said about Israel — as a matter of fact, I was pleasantly surprised," Brian Jacobs, a Texas pastor who attended Wednesday's meeting, told Business Insider. "It helped answer a lot of questions that I had."

Read more:

Labels:

breaking,

campaign,

caucus,

facebook,

feedburner,

freedom,

jay-z and kanye,

jenna,

los angeles,

Mitt Romney,

OBAMA,

politics,

republican,

Ron paul,

solar,

stockton

Location:

Washington, DC, USA

Saturday, March 31, 2012

RON PAUL'S REVOLUTION IS GETTING STRONGER!

Labels:

constitution,

feedburner,

fraud,

freedom,

healthcare,

high,

liberty,

lies,

lil wayne,

OBAMA,

owl,

OZ,

politics,

poll,

population,

quotes,

romney,

Ron paul

Location:

District of Columbia, USA

Thursday, March 29, 2012

Who to turn to? The youth has the future, counterparts maybe disqualified

A conflict of interestseems to arise with all the other Candidates, besides myself and Tony Stevens, based on the fact that they will all have to bring up the city employees' pensions, being that it is one of the top priorities for the City's agenda. Only one of the other Candidates are able to vote on this extensively overpaid, but dramatically underfunded, so it's a key factor to Stockton's negative revenue.

Ralph Lee White is a 'Retired' City Council Member for Stockton, during the 1970's and 1980's. If he has been out of the political spectrum for so long, as with Jimmie, are out of touch with the majority of Stockton and its overwhelmingly young citizens. The same goes for Ann Johnston, because I believe she will be drafting her own notice to withdraw herself from the race. Tony and I share the one characteristic that will benefit this great city, we have no personal attachment to the City's pension reform, something that must be dealt with immediately after either one of us are elected. Fo

Why don't they stay retired? They are taking jobs from persons with little to no income, when they already have a substantial amount coming in each month, and they have an odd way of appeasing the public, by giving them more of the (expletive) they've been fed over and over.

I Gregory S. Pitsch have a plan to reduce the crime in our city, by allocating more resources to the Police Force. Yeah, even if that means a few other policies have to be eliminated completely. First and foremost we need our city to be safe enough to conduct business in for the future generation of Stocktonians. Will you help me Solve Stockton?

Ralph Lee White is a 'Retired' City Council Member for Stockton, during the 1970's and 1980's. If he has been out of the political spectrum for so long, as with Jimmie, are out of touch with the majority of Stockton and its overwhelmingly young citizens. The same goes for Ann Johnston, because I believe she will be drafting her own notice to withdraw herself from the race. Tony and I share the one characteristic that will benefit this great city, we have no personal attachment to the City's pension reform, something that must be dealt with immediately after either one of us are elected. Fo

Why don't they stay retired? They are taking jobs from persons with little to no income, when they already have a substantial amount coming in each month, and they have an odd way of appeasing the public, by giving them more of the (expletive) they've been fed over and over.

I Gregory S. Pitsch have a plan to reduce the crime in our city, by allocating more resources to the Police Force. Yeah, even if that means a few other policies have to be eliminated completely. First and foremost we need our city to be safe enough to conduct business in for the future generation of Stocktonians. Will you help me Solve Stockton?

Expert sees potential in S.J. for businesses

By Reed Fujii

Record Staff Writer

March 01, 2012 12:00 AM

STOCKTON - Revving up San Joaquin County's economic engine, particularly its existing transportation and distribution assets, was the focus Wednesday as area business development officials gathered to hear from an international logistics and site selection consultant.

Adam Wasserman, a principal of Global Logistics Development Partners of Scottsdale, Ariz., said the county was "an interesting location," at the fulcrum of the growing Central Valley and close to the Bay Area.

It has two major north-south freeways, two major railroad intermodal centers, Stockton Metropolitan Airport and the Port of Stockton.

"You sit on an inland waterway right here, and there are a lot of people very excited about the potential of what it can do," Wasserman said.

The pending opening of the marine highway, on which barges would shuttle container cargo between the Port of Oakland on the bay and inland ports in Stockton and West Sacramento, is a model for similar projects nationwide.

One now under study is the M5 Highway, a proposal to move cargo by ship along the West Coast instead of by truck along Interstate 5.

"The San Joaquin proposal is sort of a forerunner to that," Wasserman said.

But there are still many questions about whether marine shipping could compete with trucking and whether private investors will pay to find out.

"It's going to be tough," he said.

It took a federal transportation grant to underwrite the Stockton-Sacramento-Oakland marine highway project.

In addition, there are changes occurring in global transportation and challenges to overcome.

The U.S. lacks a coherent trade and transportation policy, particularly one aimed at bolstering economic growth instead of simply raising cargo volumes, Wasserman said. Such policies are a major focus, however, for trading nations from the Old World to emerging economies such as Vietnam, he said.

"They're outspending us; they're outthinking us," he said.

Another example is the Panama Canal expansion project, expected to double its capacity by 2014. It likely will redirect cargo from the ports of Los Angeles and Long Beach, in particular, to landings on the Gulf Coast, in Florida or even on the East Coast. Canada and Mexico, too, have designs on attracting cargo flows away from the United States.

It will take a continued effort for San Joaquin County to attract and accommodate new businesses in such a dynamic, global market, he said.

"You have a lot of the right ingredients, but it's not going to happen naturally," Wasserman said.

The global trade expert Wednesday toured parts of San Joaquin County and addressed a lunch meeting of the Business Team San Joaquin, a group organized by Fran Aguilera of San Joaquin County Worknet and Michael Ammann of the San Joaquin Partnership.

Team members include economic development officials from Stockton, Tracy, Lodi, Manteca and Lathrop, the county, the partnership and the Lodi Chamber of Commerce.

"We're trying to project this regionwide attunement to development," Ammann said.

On Tuesday, Wasserman was one of a half-dozen consultants addressing a forum in Sacramento organized by TeamCalifornia, a statewide group of economic development experts.

Tuesday, March 27, 2012

Thursday, March 15, 2012

Tuesday, March 13, 2012

Ron Paul Wins First Caucus: MSM Changes Rules, Reports Romney Wins

Republican presidential candidate Ron Paul secured his first caucus victory over the weekend, by winning 29 percent of the popular vote among the people of the U.S. Virgin Islands. However, the mainstream media decided to report that despite coming in second with 26 percent, Mitt Romney was the real winner.

The Republican Party of the U.S. Virgin Islands reported the results as “112 to Paul (29%), 101 to Romney (26%), 23 to Santorum (6%), 18 to Gingrich (5%),”

In response, The AP and other mainstream reports yesterday claimed that Mitt Romney won caucus, because he stands to come away with more delegates.

Ron Paul supporters and the campaign itself have been tirelessly pointing out that in many of the states that have already held primaries and caucuses, the amount of delegates the Congressman has secured does not always reflect his positioning in the straw polls. Indeed, in Iowa and New Hampshire Paul secured as many delegates as Romney and Santorum.

Yet the media has always reported the winner as the candidate who won the highest percentage in the popular vote.

Not so this time around. When Ron Paul secures a caucus victory, the media changes the rules and declares it is the delegate count that determines the real winner.

“The media is reporting that Mitt Romney won the U.S. Virgin Island Caucus when Ron Paul actually won the popular vote,” wrote the Paul campaign team in an email to supporters.

“If the popular vote means you’ve won, then Ron Paul just won the U.S. Virgin Island Caucus. If collecting delegates equals victory, then Paul stands to do well there too.” the Paul campaign added.

“The media is trying to have it both ways with Romney and the Virgin Island Caucus while ignoring Ron Paul’s actual straw poll first place victory,”

Paul’s official campaign blogger Jack Hunter explains how the media changed the rules below:

Romney stands to win more delegates because, like some US states, The Virgin Islands directly elect delegates in a process that is separate from the caucuses. The six delegates with the most support get to go to the national convention.

As such, Romney won three delegates plus three more via RNC member pledges. He also picked up a uncommitted delegate after the balloting, to bring his total delegates to seven. Ron Paul will take one delegate.

However, the facts show that Ron Paul unquestionably “won” the U.S. Virgin Island Caucus, in the same way Santorum “won” Iowa, Romney “won” New Hampshire, and Gingrich “won” South Carolina.

Portions of the mainstream media know this is the case, and have blatantly ignored it, simply because they do not wish to see Paul, the only anti-establishment candidate, doing well in the race.

The next states to hold primary elections are Mississippi and Alabama. Caucuses will also be held in Hawaii and the American Samoa this Tuesday.

—————————————————————-

Steve Watson is the London based writer and editor for Alex Jones’ Infowars.net, and Prisonplanet.com. He has a Masters Degree in International Relations from the School of Politics at The University of Nottingham in England.

Tuesday, March 6, 2012

Friday, March 2, 2012

HOW SANTORUM REJECTS THE CONSTITUTION

More than anything else, the U.S. Constitution is an outline of the concept of federalism. Federalism is the very basis, or is supposed to be the very basis, of American government. This doesn’t register one bit with Rick Santorum. Writes Ann Coulter:

Even when I agree with Rick Santorum, listening to him argue the point almost makes me change my mind.

I also wonder why he’s running for president, rather than governor, when the issues closest to his heart are family-oriented matters about which the federal government can, and should, do very little.

It’s strange that Santorum doesn’t seem to understand the crucial state-federal divide bequeathed to us by the framers of our Constitution, inasmuch as it is precisely that difference that underlies his own point that states could ban contraception.

Of course they can. States could outlaw purple hats or Gummi bears under our Constitution!

State constitutions, laws, judicial rulings or the people themselves, voting democratically, tend to prevent such silly state bans from arising. But the Constitution written by James Madison, et al, does not prevent a state’s elected representatives from enacting them.

The Constitution mostly places limits on what the federal government can do. Only in a few instances does it restrict what states can do.

A state cannot, for example, infringe on the people’s right to bear arms or to engage in the free exercise of religion. A state can’t send a senator to the U.S. Congress if he is under 30 years old. But with rare exceptions, the Constitution leaves states free to govern themselves as they see fit.

In New York City, they can have live sex clubs and abortion on demand, but no salt or smoking sections. In Tennessee, they can ban abortion, but have salt, creches and 80 mph highways. At least that’s how it’s supposed to work.

And yet when Santorum tried to explain why states could ban contraception to Bill O’Reilly back in January, not once did he use the words “Constitution,” “constitutionally,” “federalism,” their synonyms or derivatives. Lawyers who are well familiar with the Constitution had no idea what Santorum was talking about.

He genuinely does not seem to understand the Constitution’s federalist framework, except as a brief talking point on the way to saying states can ban contraception…

If he truly believed in the Constitution, Santorum wouldn’t be promoting big social programs out of the federal government, such as tripling the child tax credit exemption and voting for “No Child Left Behind.”

No federalist can support this man.

For those who claim to be “constitutional conservatives” supporting Santorum basically renders that label meaningless. Santorum has repeatedly attacked the 10th amendment, which most of the Founders considered the strongest emphasis possible of what the entire Constitution was really all about. I made this same point about Santorum, his ignorance of the Constitution and his rejection of federalism at The Daily Callerearlier this week.

Even when I agree with Rick Santorum, listening to him argue the point almost makes me change my mind.

I also wonder why he’s running for president, rather than governor, when the issues closest to his heart are family-oriented matters about which the federal government can, and should, do very little.

It’s strange that Santorum doesn’t seem to understand the crucial state-federal divide bequeathed to us by the framers of our Constitution, inasmuch as it is precisely that difference that underlies his own point that states could ban contraception.

Of course they can. States could outlaw purple hats or Gummi bears under our Constitution!

State constitutions, laws, judicial rulings or the people themselves, voting democratically, tend to prevent such silly state bans from arising. But the Constitution written by James Madison, et al, does not prevent a state’s elected representatives from enacting them.

The Constitution mostly places limits on what the federal government can do. Only in a few instances does it restrict what states can do.

A state cannot, for example, infringe on the people’s right to bear arms or to engage in the free exercise of religion. A state can’t send a senator to the U.S. Congress if he is under 30 years old. But with rare exceptions, the Constitution leaves states free to govern themselves as they see fit.

In New York City, they can have live sex clubs and abortion on demand, but no salt or smoking sections. In Tennessee, they can ban abortion, but have salt, creches and 80 mph highways. At least that’s how it’s supposed to work.

And yet when Santorum tried to explain why states could ban contraception to Bill O’Reilly back in January, not once did he use the words “Constitution,” “constitutionally,” “federalism,” their synonyms or derivatives. Lawyers who are well familiar with the Constitution had no idea what Santorum was talking about.

He genuinely does not seem to understand the Constitution’s federalist framework, except as a brief talking point on the way to saying states can ban contraception…

If he truly believed in the Constitution, Santorum wouldn’t be promoting big social programs out of the federal government, such as tripling the child tax credit exemption and voting for “No Child Left Behind.”

No federalist can support this man.

For those who claim to be “constitutional conservatives” supporting Santorum basically renders that label meaningless. Santorum has repeatedly attacked the 10th amendment, which most of the Founders considered the strongest emphasis possible of what the entire Constitution was really all about. I made this same point about Santorum, his ignorance of the Constitution and his rejection of federalism at The Daily Callerearlier this week.

Thursday, March 1, 2012

Stockton Going Broke Shows Cop Pay Rising as California Property Collapsed

By Alison Vekshin

The bankruptcy that Stockton (3654MF), California, resisted for three years is now at its doorstep, spurred by the weight of retiree costs, the housing bust and accounting blunders that drained the city’s coffers.

Stockton, 80 miles (130 kilometers) east of San Francisco, rode the boom-and-bust cycle of the 2000s with a surge in new- home construction that attracted buyers seeking an affordable alternative to Bay Area real estate. Then a crash came, as homeowners faced a wave of foreclosures that sapped the city’s tax-revenue gains.

The city born in the gold rush has struggled for decades, relying on revenue from farming and shipping at its river port. Meanwhile it granted employees some of the state’s most generous benefits, and now has 94 retirees with pensions of at least $100,000 a year -- more than twice as many as some comparably- sized California cities. It has a history of ethnic tension and the notoriety of a 1989 schoolyard shooting in which five children were gunned down.

“We’re really struggling,” City Council member Dale Fritchen, 51, said by telephone Feb. 28. “There were horrible decisions made. City leaders spent money faster than it was coming in, thinking that the gravy train would never go away.”

This week, Stockton moved closer to bankruptcy with a City Council decision to preserve cash by defaulting on $2 million in bond payments. It also voted to begin a mediation process required under state law prior to seeking court protection. The city said its goal is to avoid bankruptcy. If it files, it would be the most populous U.S. city to do so.

Bankruptcy Code

From California to Rhode Island, cities are using the federal bankruptcy code to get out from under billions of dollars in obligations they can’t afford. Central Falls, Rhode Island, filed for protection in August after failing to win concessions from its unions. Jefferson County, Alabama, turned in the biggest municipal bankruptcy in U.S. history last November, with $4.2 billion in debt. Vallejo, California, sought Chapter 9 reorganization in 2008.

Stockton’s unemployment rate soared to 17.3 percent in 2010, the country’s sixth-highest, from 7 percent in 2000, according to the California Employment Development Department. The foreclosure rate in the Stockton metropolitan area was the second-highest in the U.S. last year, after Las Vegas, according to Irvine, California-based RealtyTrac Inc. Violent crime in the Stockton area was the eighth-highest rate in the nation in 2010, according to FBI data.

Gold Rush

Stockton was founded in 1849 as a supply center for people rushing to work in mining, a year after gold was discovered on the American River east of Sacramento. Early settlers flocked from eastern states and from Asia, Europe and Africa.

Later, shipbuilding became a major industry in Stockton, with its deep-water port on the San Joaquin River. Agriculture surged as the region supplied asparagus, cherries, tomatoes, walnuts and almonds.

In the 1990s, city officials doled out generous retirement health benefits without ensuring the city could afford the payments over time, City Manager Bob Deis said at a Feb. 24 news conference. A worker employed as little as a month could qualify for city-paid retirement health care for the retiree and his or her spouse for life, Deis said.

“It was not a Cadillac plan,” Vice Mayor Kathy Miller said in a telephone interview. “It’s a Lamborghini plan. No one in the private sector had anything like that.”

Among expenses the city can no longer afford is a $417 million unfunded retiree health-care liability.

‘Nobody Asked’

“The problem is, nobody asked the question: ‘How do you fund it?’ And consequently there was no money set aside to fund those commitments,” Deis said. “It was an unsound decision and it has similarities to a Ponzi scheme.” In the 2000s, as housing prices soared in San Francisco and Silicon Valley, buyers from San Jose to Oakland seeking affordable alternatives flocked to Stockton, where starter homes cost around $400,000. Single-family home construction, which had averaged 2,500 units a year from 1991 to 1997, tripled to 7,500 annually from 2003 and 2005, according to Robert Denk, senior economist at the Washington-based National Association of Home Builders.

The city’s population grew 20 percent in a decade, to 291,707 in 2010 from 243,771 in 2000, driven by a surge in Hispanics who identify themselves as Mexican, according to U.S. Census Bureau data. That ethnic group jumped 56 percent in the period, to 104,172 from 66,900, while the black population grew 30 percent and the Asian population rose 29 percent, Census figures show.

‘Boom Time’

“Money was just pouring into the city coffers for development fees and permits,” Miller said. “Property taxes were going through the roof. It was boom-time.”

Pay and benefit packages continued to swell. In 2005, the city completed a new ballpark and arena on the waterfront using bond funds. “There was an unspoken policy that to keep the unions from complaining about the amount of money being spent on projects, the easiest way to do that was to continue sweetening their compensation packages,” Miller said.

Among those measures were automatic salary increases regardless of whether the city had the revenue to support them. The contract with the fire union required the city to compare its pay with that of 16 cities including Huntington Beach, Anaheim and Torrance. Stockton firefighters’ salaries were required to rank fifth-highest, according to the city’s May 2011 emergency declaration document.

$100,000 Pensions

Stockton retirees also fared well. The 94 with pensions of more than $100,000 compares with 38 in Bakersfield, which has 347,000 residents, and 35 in Chula Vista, with a population of 244,000, according to data compiled from state pension records by the California Foundation for Fiscal Responsibility, a Citrus Heights-based group that advocates pension reform.

An epidemic of foreclosures reached Stockton in 2007, as the recession left thousands of homeowners unable to afford their mortgages. Home construction collapsed and housing prices plummeted.

Revenue dwindled to an estimated $161.8 million in fiscal 2012 from $203.1 million in fiscal 2009. The city fired 25 percent of its workforce.

In Stockton’s San Joaquin County, assessed property values tumbled almost 11 percent in fiscal 2010, followed by 3.9 percent in 2011 and 4 percent in the current year, according to the county’s website.

‘Drastic Decisions’

“In the beginning, when this whole economic bubble burst, everyone had the attitude, ‘We’ll just avoid making drastic decisions and in a year or two things will be back to normal,’” Miller said.

The base pay for a Stockton police officer can be as much as $76,860, while a sergeant’s can reach $90,836, according to data provided by the city. In 2010, 87 percent of police officers got additional pay that added 8.7 percent for a canine handler, 4.3 percent for SWAT and 5 percent in “longevity pay” at six years of service. All are included in the calculation of retirement benefits.

“We are now the fifth-lowest paid police organization in the county where we handle the majority of the calls,” Kathryn Nance, a Stockton Police Officers’ Association board member, said in a telephone interview.

By 2009, city officials began considering bankruptcy.

Bankruptcy Protection

Fritchen, the council member, asked the city attorney’s office to lay out the pros and cons of bankruptcy protection at a budget committee meeting.

A year later, in May 2010, the city declared a fiscal emergency to deal with a $23 million deficit. The declaration allowed the city to make changes to existing labor contracts.

Crime escalated as the police force was reduced by about 27 percent to 324 sworn officers from 441, according to Pete Smith, a police spokesman. There were a record 58 homicides last year, most involving gang violence, Smith said.

“We’re losing our grip on some of the more troubled neighborhoods and don’t have the ability to police the city as proactively as we did,” Smith said.

In the spring of 2011, Deis met with about 15 police employees and budget officials to seek concessions from the union.

‘Breaking Our Contract’

“He said if we continue to fight on them breaking our contract, then he is going to push the reset button and go bankrupt and we will all lose,” Steve Leonesio, president of the police union, said in a telephone interview. The union is suing the city, challenging its authority to reduce benefits under the emergency declaration.

Last year, city officials uncovered bookkeeping errors requiring $15 million in budget cuts that “will have the effect of stripping Stockton’s cupboards bare,” Deis said.

The mistakes included double-counting of $500,000 in parking-ticket revenues and overstating the city’s available balance by an estimated $2.8 million.

On Feb. 24, Deis walked into a news conference at City Hall and announced that the errors and the recession represent “the knockout blow” for the city’s finances. He recommended the city invoke the state bankruptcy law. “We see no viable alternative,” he said.

Stockton, 80 miles (130 kilometers) east of San Francisco, rode the boom-and-bust cycle of the 2000s with a surge in new- home construction that attracted buyers seeking an affordable alternative to Bay Area real estate. Then a crash came, as homeowners faced a wave of foreclosures that sapped the city’s tax-revenue gains.

The city born in the gold rush has struggled for decades, relying on revenue from farming and shipping at its river port. Meanwhile it granted employees some of the state’s most generous benefits, and now has 94 retirees with pensions of at least $100,000 a year -- more than twice as many as some comparably- sized California cities. It has a history of ethnic tension and the notoriety of a 1989 schoolyard shooting in which five children were gunned down.

“We’re really struggling,” City Council member Dale Fritchen, 51, said by telephone Feb. 28. “There were horrible decisions made. City leaders spent money faster than it was coming in, thinking that the gravy train would never go away.”

This week, Stockton moved closer to bankruptcy with a City Council decision to preserve cash by defaulting on $2 million in bond payments. It also voted to begin a mediation process required under state law prior to seeking court protection. The city said its goal is to avoid bankruptcy. If it files, it would be the most populous U.S. city to do so.

Bankruptcy Code

From California to Rhode Island, cities are using the federal bankruptcy code to get out from under billions of dollars in obligations they can’t afford. Central Falls, Rhode Island, filed for protection in August after failing to win concessions from its unions. Jefferson County, Alabama, turned in the biggest municipal bankruptcy in U.S. history last November, with $4.2 billion in debt. Vallejo, California, sought Chapter 9 reorganization in 2008.

Stockton’s unemployment rate soared to 17.3 percent in 2010, the country’s sixth-highest, from 7 percent in 2000, according to the California Employment Development Department. The foreclosure rate in the Stockton metropolitan area was the second-highest in the U.S. last year, after Las Vegas, according to Irvine, California-based RealtyTrac Inc. Violent crime in the Stockton area was the eighth-highest rate in the nation in 2010, according to FBI data.

Gold Rush

Stockton was founded in 1849 as a supply center for people rushing to work in mining, a year after gold was discovered on the American River east of Sacramento. Early settlers flocked from eastern states and from Asia, Europe and Africa.

Later, shipbuilding became a major industry in Stockton, with its deep-water port on the San Joaquin River. Agriculture surged as the region supplied asparagus, cherries, tomatoes, walnuts and almonds.

In the 1990s, city officials doled out generous retirement health benefits without ensuring the city could afford the payments over time, City Manager Bob Deis said at a Feb. 24 news conference. A worker employed as little as a month could qualify for city-paid retirement health care for the retiree and his or her spouse for life, Deis said.

“It was not a Cadillac plan,” Vice Mayor Kathy Miller said in a telephone interview. “It’s a Lamborghini plan. No one in the private sector had anything like that.”

Among expenses the city can no longer afford is a $417 million unfunded retiree health-care liability.

‘Nobody Asked’

“The problem is, nobody asked the question: ‘How do you fund it?’ And consequently there was no money set aside to fund those commitments,” Deis said. “It was an unsound decision and it has similarities to a Ponzi scheme.” In the 2000s, as housing prices soared in San Francisco and Silicon Valley, buyers from San Jose to Oakland seeking affordable alternatives flocked to Stockton, where starter homes cost around $400,000. Single-family home construction, which had averaged 2,500 units a year from 1991 to 1997, tripled to 7,500 annually from 2003 and 2005, according to Robert Denk, senior economist at the Washington-based National Association of Home Builders.

The city’s population grew 20 percent in a decade, to 291,707 in 2010 from 243,771 in 2000, driven by a surge in Hispanics who identify themselves as Mexican, according to U.S. Census Bureau data. That ethnic group jumped 56 percent in the period, to 104,172 from 66,900, while the black population grew 30 percent and the Asian population rose 29 percent, Census figures show.

‘Boom Time’

“Money was just pouring into the city coffers for development fees and permits,” Miller said. “Property taxes were going through the roof. It was boom-time.”

Pay and benefit packages continued to swell. In 2005, the city completed a new ballpark and arena on the waterfront using bond funds. “There was an unspoken policy that to keep the unions from complaining about the amount of money being spent on projects, the easiest way to do that was to continue sweetening their compensation packages,” Miller said.

Among those measures were automatic salary increases regardless of whether the city had the revenue to support them. The contract with the fire union required the city to compare its pay with that of 16 cities including Huntington Beach, Anaheim and Torrance. Stockton firefighters’ salaries were required to rank fifth-highest, according to the city’s May 2011 emergency declaration document.

$100,000 Pensions

Stockton retirees also fared well. The 94 with pensions of more than $100,000 compares with 38 in Bakersfield, which has 347,000 residents, and 35 in Chula Vista, with a population of 244,000, according to data compiled from state pension records by the California Foundation for Fiscal Responsibility, a Citrus Heights-based group that advocates pension reform.

An epidemic of foreclosures reached Stockton in 2007, as the recession left thousands of homeowners unable to afford their mortgages. Home construction collapsed and housing prices plummeted.

Revenue dwindled to an estimated $161.8 million in fiscal 2012 from $203.1 million in fiscal 2009. The city fired 25 percent of its workforce.

In Stockton’s San Joaquin County, assessed property values tumbled almost 11 percent in fiscal 2010, followed by 3.9 percent in 2011 and 4 percent in the current year, according to the county’s website.

‘Drastic Decisions’

“In the beginning, when this whole economic bubble burst, everyone had the attitude, ‘We’ll just avoid making drastic decisions and in a year or two things will be back to normal,’” Miller said.

The base pay for a Stockton police officer can be as much as $76,860, while a sergeant’s can reach $90,836, according to data provided by the city. In 2010, 87 percent of police officers got additional pay that added 8.7 percent for a canine handler, 4.3 percent for SWAT and 5 percent in “longevity pay” at six years of service. All are included in the calculation of retirement benefits.

“We are now the fifth-lowest paid police organization in the county where we handle the majority of the calls,” Kathryn Nance, a Stockton Police Officers’ Association board member, said in a telephone interview.

By 2009, city officials began considering bankruptcy.

Bankruptcy Protection

Fritchen, the council member, asked the city attorney’s office to lay out the pros and cons of bankruptcy protection at a budget committee meeting.

A year later, in May 2010, the city declared a fiscal emergency to deal with a $23 million deficit. The declaration allowed the city to make changes to existing labor contracts.

Crime escalated as the police force was reduced by about 27 percent to 324 sworn officers from 441, according to Pete Smith, a police spokesman. There were a record 58 homicides last year, most involving gang violence, Smith said.

“We’re losing our grip on some of the more troubled neighborhoods and don’t have the ability to police the city as proactively as we did,” Smith said.

In the spring of 2011, Deis met with about 15 police employees and budget officials to seek concessions from the union.

‘Breaking Our Contract’

“He said if we continue to fight on them breaking our contract, then he is going to push the reset button and go bankrupt and we will all lose,” Steve Leonesio, president of the police union, said in a telephone interview. The union is suing the city, challenging its authority to reduce benefits under the emergency declaration.

Last year, city officials uncovered bookkeeping errors requiring $15 million in budget cuts that “will have the effect of stripping Stockton’s cupboards bare,” Deis said.

The mistakes included double-counting of $500,000 in parking-ticket revenues and overstating the city’s available balance by an estimated $2.8 million.

On Feb. 24, Deis walked into a news conference at City Hall and announced that the errors and the recession represent “the knockout blow” for the city’s finances. He recommended the city invoke the state bankruptcy law. “We see no viable alternative,” he said.

Tuesday, February 28, 2012

Monday, February 27, 2012

America For Ron Paul

Sunday, February 26th, marked an exciting day for Ron Paul Supporters, when A new Coalition was formed, America For Ron Paul. Supporters of all ages, and ethnicity joined forces, in Mountain House, CA, amassing 4,000+ people in attendance. All of his loyal supporters were enjoying a day in America, with music, games, and speakers to entertain the large crowd. Ron Paul was not scheduled to show, he is struggling with the media, and the voter fraud that seems to be encompassing the nomination for the Republican Party.

Labels:

GOP,

jobs,

OBAMA,

OhZee,

oprah,

politics,

republican,

rick,

romney,

Ron paul,

truth,

unemployment,

USA,

wisdom,

ww3,

young

Location:

Central Pkwy, Tracy, CA 95391, USA

Friday, February 24, 2012

O'REILLY: It was mutual destruction. Now you can handle any weaponry or any kind of thing to surrogates, who will do your killing for you. Look, if you don't think Iran is sponsoring terrorism, you're living in the land of Oz, congressman.

PAUL: Well, so is Saudi Arabia. What are you going to do about Saudi? What are you going to do with Pakistan?

O'REILLY: It's not a government policy in Saudi Arabia. It's just a failure to do any effective policing. It's a policy in Iran to wipe out Israel...

PAUL: It's our policy...

O'REILLY: ...to attack USA.

PAUL: It's our policy of preemptive, deliberate invasions of foreign countries and occupying these countries that has jeopardized our safety. This blowback principle is what caused 9/11. And we have to come to realize it. If you keep living in this dream land of saying that they attack because we're free and prosperous, believe me, we're never going to get free from fear ...

Read more: http://www.foxnews.com/story/0,2933,296404,00.html#ixzz1nHpryeq4

PAUL: Well, so is Saudi Arabia. What are you going to do about Saudi? What are you going to do with Pakistan?

O'REILLY: It's not a government policy in Saudi Arabia. It's just a failure to do any effective policing. It's a policy in Iran to wipe out Israel...

PAUL: It's our policy...

O'REILLY: ...to attack USA.

PAUL: It's our policy of preemptive, deliberate invasions of foreign countries and occupying these countries that has jeopardized our safety. This blowback principle is what caused 9/11. And we have to come to realize it. If you keep living in this dream land of saying that they attack because we're free and prosperous, believe me, we're never going to get free from fear ...

Read more: http://www.foxnews.com/story/0,2933,296404,00.html#ixzz1nHpryeq4

Thursday, February 23, 2012

Keen on slashing the national debt? Ron Paul is your man

Ron Paul ranks as the one candidate among four whose announced policies would leave America with a lower national debt than it would have under a status quo course, according to a new analysis.

By Mark Trumbull | Christian Science Monitor – 2 hrs 20 mins ago

Ron Paul has touted himself as the strongest fiscal conservative running for the Republican presidential nomination, and according to one new analysis, he may be right.

The Texas congressman ranks as the one candidate among four whose announced policies would leave America with a lower national debt than it would have under a status quo course.

That's the tentative conclusion of the Committee for a Responsible Federal Budget (CRFB), a nonpartisan fiscal watchdog group, in a report evaluating the tax and spending policies of Representative Paul, Newt Gingrich, Mitt Romney, and Rick Santorum.

It's some basic math that any cash-strapped household would understand: His cuts to federal spending would outweigh his proposed tax cuts. The other candidates so far haven't fleshed out spending-cut plans that equal or exceed their tax cuts, which reduce expected federal revenues. In all, Paul's proposals would leave the United States with a national debt equaling 76 percent of one year's gross domestic product in 2021. That would be slightly higher than the debt is today, but lower than it would be in a base-line scenario that represents current policies pursued by Congress.

Former Massachusetts Governor Romney would leave public debt at 86 percent of GDP in 2021. Former US Senator Santorum would leave debt at 104 percent of GDP. Former House Speaker Gingrich would leave it at 114 percent of GDP.

In the base-line case, debt reaches 85 percent of GDP. This assumes a continuation of Bush-era tax cuts, an ongoing "patch" to keep more Americans from being hit by the alternative minimum tax, and an annual "doc fix" for physician payments under Medicare. In this status quo scenario, the deficit would amount to more than $1 trillion in 2021.

In public opinion polls, Americans see reducing annual deficits and the nation's overall debt as a top priority (behind economic growth and job creation) for government. Many economists say the debt is already rising into a zone that could threaten the economy's stability. Paul's prescription is to tackle the problem in libertarian fashion, with a major downsizing of the federal government. His proposals, as gauged by CRFB, would reduce federal spending by some $7.5 trillion over a nine-year period. (For comparison, federal spending will total $3.6 trillion in the 2012 fiscal year, the Congressional Budget Office estimates.)

Paul's cuts would span from the military to Medicaid and beyond.

In one TV ad, Paul's campaign has shown pictures depicting the Departments of Education, Interior, Energy, Commerce, and Housing and Urban Development blowing up as federal spending is reined in. "Later, bureaucrats," the narrator says.

His plan also calls for significant reductions in taxes on personal income, estates, and corporate income – totaling $5.2 trillion over the nine-year period that CRFB analyzed.

The CRFB analysis is tentative for several reasons. The group highlights estimates from an "intermediate scenario" for each candidate, based on policies each has spelled out in some detail. Romney doesn't get credit, for example, for his currently vague call for capping federal spending at 20 percent of GDP.

The CRFB says it will update its report as candidates revise or flesh out their economic plans.

The report also shows an alternative "low-debt" scenario, which essentially takes candidate pledges at face value, even if the proposals currently lack in detail.

In this scenario, Paul also leads the Republican pack in fiscal discipline, with debt falling to 67 percent of GDP. Romney and Santorum (who has a goal to cut $5 trillion in federal spending in five years) would also leave the US with lower debt than under the status quo case. Another caveat to the CRFB analysis: Paul's proposal to end the Federal Reserve would have wide and uncertain impacts on the economy. The CRFB takes only a first glance at this issue. It emphasizes an "intermediate-debt" scenario in which shutting down the Fed would cost the nation $430 billion over the nine-year period. That's because the Fed would no longer be making annual payments of surpluses from its operations to the US Treasury.

In the "low-debt" scenario, the CRFB credits the Paul plan with saving some $1.2 trillion by shutting down the Fed. But the group calls his idea "incomplete," saying that he proposes what amounts to a default by the Fed on the reserves it now holds for private banks. Some budget experts say these numbers regarding the Federal Reserve show only one implication of Paul's proposal. The bigger issue would be this: How would the economy function if the nation had no central bank to manage monetary policy?

"The impact on the budget would likely be major," said Alice Rivlin, a former Fed official who spoke at a Thursday panel discussion at the New America Foundation in Washington, at which the CRFB report was presented.

She didn't elaborate on the potential consequences. Many economists, while having varying views on optimal Fed policy, argue that the central bank played a key role in preventing the financial crisis of 2008 from pitching the economy into a 1930s-style depression. Paul has argued that a return to the gold standard would allow the economy to function with a "sound money" alternative to the current inflation-prone currency.

RECOMMENDED: The roar of Ron Paul – five of his unorthodox views on the economy Get daily or weekly updates from CSMonitor.com delivered to your inbox. Sign up today.

By Mark Trumbull | Christian Science Monitor – 2 hrs 20 mins ago

Ron Paul has touted himself as the strongest fiscal conservative running for the Republican presidential nomination, and according to one new analysis, he may be right.

The Texas congressman ranks as the one candidate among four whose announced policies would leave America with a lower national debt than it would have under a status quo course.

That's the tentative conclusion of the Committee for a Responsible Federal Budget (CRFB), a nonpartisan fiscal watchdog group, in a report evaluating the tax and spending policies of Representative Paul, Newt Gingrich, Mitt Romney, and Rick Santorum.

It's some basic math that any cash-strapped household would understand: His cuts to federal spending would outweigh his proposed tax cuts. The other candidates so far haven't fleshed out spending-cut plans that equal or exceed their tax cuts, which reduce expected federal revenues. In all, Paul's proposals would leave the United States with a national debt equaling 76 percent of one year's gross domestic product in 2021. That would be slightly higher than the debt is today, but lower than it would be in a base-line scenario that represents current policies pursued by Congress.

Former Massachusetts Governor Romney would leave public debt at 86 percent of GDP in 2021. Former US Senator Santorum would leave debt at 104 percent of GDP. Former House Speaker Gingrich would leave it at 114 percent of GDP.

In the base-line case, debt reaches 85 percent of GDP. This assumes a continuation of Bush-era tax cuts, an ongoing "patch" to keep more Americans from being hit by the alternative minimum tax, and an annual "doc fix" for physician payments under Medicare. In this status quo scenario, the deficit would amount to more than $1 trillion in 2021.

In public opinion polls, Americans see reducing annual deficits and the nation's overall debt as a top priority (behind economic growth and job creation) for government. Many economists say the debt is already rising into a zone that could threaten the economy's stability. Paul's prescription is to tackle the problem in libertarian fashion, with a major downsizing of the federal government. His proposals, as gauged by CRFB, would reduce federal spending by some $7.5 trillion over a nine-year period. (For comparison, federal spending will total $3.6 trillion in the 2012 fiscal year, the Congressional Budget Office estimates.)

Paul's cuts would span from the military to Medicaid and beyond.

In one TV ad, Paul's campaign has shown pictures depicting the Departments of Education, Interior, Energy, Commerce, and Housing and Urban Development blowing up as federal spending is reined in. "Later, bureaucrats," the narrator says.

His plan also calls for significant reductions in taxes on personal income, estates, and corporate income – totaling $5.2 trillion over the nine-year period that CRFB analyzed.

The CRFB analysis is tentative for several reasons. The group highlights estimates from an "intermediate scenario" for each candidate, based on policies each has spelled out in some detail. Romney doesn't get credit, for example, for his currently vague call for capping federal spending at 20 percent of GDP.

The CRFB says it will update its report as candidates revise or flesh out their economic plans.

The report also shows an alternative "low-debt" scenario, which essentially takes candidate pledges at face value, even if the proposals currently lack in detail.

In this scenario, Paul also leads the Republican pack in fiscal discipline, with debt falling to 67 percent of GDP. Romney and Santorum (who has a goal to cut $5 trillion in federal spending in five years) would also leave the US with lower debt than under the status quo case. Another caveat to the CRFB analysis: Paul's proposal to end the Federal Reserve would have wide and uncertain impacts on the economy. The CRFB takes only a first glance at this issue. It emphasizes an "intermediate-debt" scenario in which shutting down the Fed would cost the nation $430 billion over the nine-year period. That's because the Fed would no longer be making annual payments of surpluses from its operations to the US Treasury.

In the "low-debt" scenario, the CRFB credits the Paul plan with saving some $1.2 trillion by shutting down the Fed. But the group calls his idea "incomplete," saying that he proposes what amounts to a default by the Fed on the reserves it now holds for private banks. Some budget experts say these numbers regarding the Federal Reserve show only one implication of Paul's proposal. The bigger issue would be this: How would the economy function if the nation had no central bank to manage monetary policy?

"The impact on the budget would likely be major," said Alice Rivlin, a former Fed official who spoke at a Thursday panel discussion at the New America Foundation in Washington, at which the CRFB report was presented.

She didn't elaborate on the potential consequences. Many economists, while having varying views on optimal Fed policy, argue that the central bank played a key role in preventing the financial crisis of 2008 from pitching the economy into a 1930s-style depression. Paul has argued that a return to the gold standard would allow the economy to function with a "sound money" alternative to the current inflation-prone currency.

RECOMMENDED: The roar of Ron Paul – five of his unorthodox views on the economy Get daily or weekly updates from CSMonitor.com delivered to your inbox. Sign up today.

Wednesday, February 22, 2012

Obama Seeks 28 Percent Corporate Tax Rate

By JIM KUHNHENN

WASHINGTON (AP) — President Barack Obama is proposing to cut the corporate tax rate from 35 percent to 28 percent and wants an even lower effective rate for manufacturers, a senior administration official says, as the White House lays down an election-year marker in the debate over tax policy.

In turn, corporations would have to give up dozens of loopholes and subsidies that they now enjoy. Corporations with overseas operations would also face a minimum tax on their foreign earnings.

Treasury Secretary Timothy Geithner on Wednesday was to detail aspects of Obama's proposed overhaul of the corporate tax system, a plan the president outlined in general terms in his State of the Union speech last month.

Chances of accomplishing such change in the tax system are slim in a year dominated mostly with presidential and congressional elections. But for Obama, the proposal is part of a larger tax plan that is central to his re-election strategy.

The corporate tax plan dovetails with Obama's call for raising taxes on millionaires and maintaining current rates on individuals making $200,000 or less.

The 35 percent nominal corporate tax rate is the highest in the world after Japan. But deductions, credits and exemptions allow many corporations to pay taxes at a much lower rate.

Under the framework proposed by the administration, the rate cuts, closed loopholes and the minimum tax on overseas earning would result in no increase to the deficit.

That means that many businesses that slip through loopholes or enjoy subsidies and pay an effective tax rate that is substantially less than the 35 percent corporate tax could end up paying more under Obama's plan. Others, however, would pay less while some would simply benefit from a more simplified system.

The official said the Obama plan aims to help U.S. businesses, especially manufacturers who face strong international competition. Obama's plan would lower the effective rate for manufacturers to 25 percent while emphasizing development of clean energy systems. The administration official spoke on condition of anonymity to describe what the administration will do.

The New York Times first reported details of the plan in its online edition early Wednesday.

Many members of both parties have said they favor overhauling the nation's individual and corporate tax systems, which they complain have rates that are too high and are riddled with too many deductions.

The corporate tax debate has made its way into the presidential contest. Former Massachusetts Gov. Mitt Romney has called for a 25 percent rate, former House Speaker Newt Gingrich, R-Ga., would cut the corporate tax rate to 12.5 percent, and former Sen. Rick Santorum, R-Pa., would exempt domestic manufacturers from the corporate tax and halve the top rate for other businesses.

While Obama has been promoting various aspects of his economic agenda in personal appearances and speeches, the decision to leave the corporate tax plan to the Treasury Department to unveil signaled its lower priority. What's more, the administration's framework leaves much for Congress to decide — a deliberate move by the administration to encourage negotiations but which also doesn't subject the plan to detailed scrutiny.

Obama's plan is not as ambitious as a House Republican proposal that would lower the corporate rate to 25 percent. Still, Obama has said corporate tax rates are too high and has proposed eliminating tax breaks for American companies that move jobs and profits overseas. He also has proposed giving tax breaks to U.S. manufacturers, to firms that return jobs to this country and to companies that relocate to some communities that have lost big employers.

Geithner told a House committee last week that the administration wants to create more incentives for corporations to invest in the United States.

"We want to bring down the rate, and we think we can, to a level that's closer to the average of that of our major competitors," Geithner told the House Ways and Means Committee.

White House economic adviser Gene Sperling has advocated a minimum tax on global profits. Currently many corporations do not invest overseas profits in the United States to avoid the 35 percent tax rate.

___ Associated Press writer Alan Fram contributed to this report.

WASHINGTON (AP) — President Barack Obama is proposing to cut the corporate tax rate from 35 percent to 28 percent and wants an even lower effective rate for manufacturers, a senior administration official says, as the White House lays down an election-year marker in the debate over tax policy.

In turn, corporations would have to give up dozens of loopholes and subsidies that they now enjoy. Corporations with overseas operations would also face a minimum tax on their foreign earnings.

Treasury Secretary Timothy Geithner on Wednesday was to detail aspects of Obama's proposed overhaul of the corporate tax system, a plan the president outlined in general terms in his State of the Union speech last month.

Chances of accomplishing such change in the tax system are slim in a year dominated mostly with presidential and congressional elections. But for Obama, the proposal is part of a larger tax plan that is central to his re-election strategy.

The corporate tax plan dovetails with Obama's call for raising taxes on millionaires and maintaining current rates on individuals making $200,000 or less.

The 35 percent nominal corporate tax rate is the highest in the world after Japan. But deductions, credits and exemptions allow many corporations to pay taxes at a much lower rate.

Under the framework proposed by the administration, the rate cuts, closed loopholes and the minimum tax on overseas earning would result in no increase to the deficit.

That means that many businesses that slip through loopholes or enjoy subsidies and pay an effective tax rate that is substantially less than the 35 percent corporate tax could end up paying more under Obama's plan. Others, however, would pay less while some would simply benefit from a more simplified system.

The official said the Obama plan aims to help U.S. businesses, especially manufacturers who face strong international competition. Obama's plan would lower the effective rate for manufacturers to 25 percent while emphasizing development of clean energy systems. The administration official spoke on condition of anonymity to describe what the administration will do.

The New York Times first reported details of the plan in its online edition early Wednesday.

Many members of both parties have said they favor overhauling the nation's individual and corporate tax systems, which they complain have rates that are too high and are riddled with too many deductions.

The corporate tax debate has made its way into the presidential contest. Former Massachusetts Gov. Mitt Romney has called for a 25 percent rate, former House Speaker Newt Gingrich, R-Ga., would cut the corporate tax rate to 12.5 percent, and former Sen. Rick Santorum, R-Pa., would exempt domestic manufacturers from the corporate tax and halve the top rate for other businesses.

While Obama has been promoting various aspects of his economic agenda in personal appearances and speeches, the decision to leave the corporate tax plan to the Treasury Department to unveil signaled its lower priority. What's more, the administration's framework leaves much for Congress to decide — a deliberate move by the administration to encourage negotiations but which also doesn't subject the plan to detailed scrutiny.

Obama's plan is not as ambitious as a House Republican proposal that would lower the corporate rate to 25 percent. Still, Obama has said corporate tax rates are too high and has proposed eliminating tax breaks for American companies that move jobs and profits overseas. He also has proposed giving tax breaks to U.S. manufacturers, to firms that return jobs to this country and to companies that relocate to some communities that have lost big employers.

Geithner told a House committee last week that the administration wants to create more incentives for corporations to invest in the United States.

"We want to bring down the rate, and we think we can, to a level that's closer to the average of that of our major competitors," Geithner told the House Ways and Means Committee.

White House economic adviser Gene Sperling has advocated a minimum tax on global profits. Currently many corporations do not invest overseas profits in the United States to avoid the 35 percent tax rate.

___ Associated Press writer Alan Fram contributed to this report.

Sunday, February 19, 2012

Dr. Ron Paul; His Take On Taxes

The power to tax is the power to destroy, which is why Ron Paul will never support higher taxes.

Our national debt is currently over $14 trillion, with the government spending nearly $2 trillion more per year than it collects. The American people should not have to pay for Washington’s reckless and out-of-control appetite for debt.

High taxes stifle innovation, prevent saving, destroy production, crush the middle class and the poor, and discourage investment. Every American is entitled to the fruits of his labor, especially during these tough economic times.

Lowering taxes will leave you more money to take care of yourself and your family, and it will allow businesses greater opportunities to hire new workers, increase current salaries, and expand their companies.

As President, Ron Paul will support a Liberty Amendment to the Constitution to abolish the income and death taxes. And he will be proud to be the one who finally turns off the lights at the IRS for good.

Capital gains taxes, which punish you for success (and interfere with your efforts to hedge against inflation by purchasing gold and silver coins), should also be immediately repealed.

Struggling college students and those working to support their families would be greatly benefited and receive an immediate pay raise by eliminating taxes on tips.

As a congressman, Ron Paul has consistently endorsed legislation to let Americans claim more tax credits and deductions, including on educational costs, alternative energy vehicles, and health care. He also believes it is immoral to tax senior citizens twice by requiring them to include Social Security benefits in their gross income at tax time. A first step to eliminating that requirement would be to repeal the 1993 increase in taxes on Social Security benefits. Then we must abolish that tax entirely.

While a Flat Tax or a Fair Tax would each be a better alternative to the income tax system, Congressman Paul believes we would have to guarantee the 16th Amendment is repealed to avoid having both the income tax and one of these systems as an additional tax.

But there is a better way. Restraining federal spending by enforcing the Constitution’s strict limits on the federal government’s power would help result in a 0% income tax rate for Americans.

The answer to spending and debt is to return to a constitutionally limited government that protects liberty – not one that keeps robbing Peter to pay Paul.

Our national debt is currently over $14 trillion, with the government spending nearly $2 trillion more per year than it collects. The American people should not have to pay for Washington’s reckless and out-of-control appetite for debt.

High taxes stifle innovation, prevent saving, destroy production, crush the middle class and the poor, and discourage investment. Every American is entitled to the fruits of his labor, especially during these tough economic times.

Lowering taxes will leave you more money to take care of yourself and your family, and it will allow businesses greater opportunities to hire new workers, increase current salaries, and expand their companies.

As President, Ron Paul will support a Liberty Amendment to the Constitution to abolish the income and death taxes. And he will be proud to be the one who finally turns off the lights at the IRS for good.

Capital gains taxes, which punish you for success (and interfere with your efforts to hedge against inflation by purchasing gold and silver coins), should also be immediately repealed.

Struggling college students and those working to support their families would be greatly benefited and receive an immediate pay raise by eliminating taxes on tips.

As a congressman, Ron Paul has consistently endorsed legislation to let Americans claim more tax credits and deductions, including on educational costs, alternative energy vehicles, and health care. He also believes it is immoral to tax senior citizens twice by requiring them to include Social Security benefits in their gross income at tax time. A first step to eliminating that requirement would be to repeal the 1993 increase in taxes on Social Security benefits. Then we must abolish that tax entirely.

While a Flat Tax or a Fair Tax would each be a better alternative to the income tax system, Congressman Paul believes we would have to guarantee the 16th Amendment is repealed to avoid having both the income tax and one of these systems as an additional tax.

But there is a better way. Restraining federal spending by enforcing the Constitution’s strict limits on the federal government’s power would help result in a 0% income tax rate for Americans.

The answer to spending and debt is to return to a constitutionally limited government that protects liberty – not one that keeps robbing Peter to pay Paul.

Labels:

2012,

America,

iowa,

iran,

knkt,

political,

politics,

profit,

race,

republican,

rich people,

ron,

SF Bay Area,

stanford routt,

t,

tax,

us gov

Subscribe to:

Posts (Atom)